When considering a career in accounting, one crucial aspect often comes to mind is the salary potential. Understanding the city-wise accountant salary in India can provide valuable insights into the earning potential for both freshers and experienced professionals. The accountant salary for freshers in India can vary significantly depending on factors such as the city of employment, industry, level of experience and the organisation's size.

In metropolitan cities like Mumbai, Delhi, Bangalore and Chennai, where the cost of living is relatively higher, accountants earn higher salaries than other cities. These cities are often the financial hubs of India, hosting numerous multinational corporations, financial institutions and accounting firms. As a result, accountants working in these cities can expect more competitive compensation packages.

What are the Different Posts of Accountants in India

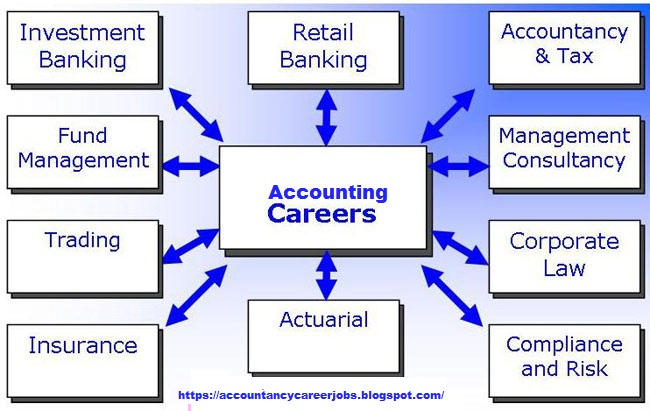

For commerce students aspiring to pursue a career in accounting, it is essential to have a comprehensive understanding of the different posts or job titles available in the field. Accounting offers various career opportunities across various industries and sectors in India. Here are some of the different posts of accountants in India:

Accountant

An Accountant is the most common entry-level position in accounting. Accountants are responsible for recording financial transactions, preparing financial statements, maintaining ledgers, reconciling accounts and assisting in budgeting and financial analysis. They play a vital role in ensuring accurate and up-to-date financial records.

Audit Assistant

An Audit Assistant works closely with auditors in examining financial records, verifying the accuracy of financial information and ensuring compliance with relevant laws and regulations. They assist in conducting internal or external audits, identifying potential financial risks or discrepancies and preparing audit reports.

Tax Accountant

Tax Accountants specialize in tax-related matters. They are responsible for preparing and filing individual, business, or organization tax returns. They stay updated with the latest tax laws and regulations, analyse financial data to determine tax liabilities and provide tax planning advice to minimize tax obligations within the legal framework.

Cost Accountant

Cost Accountants focus on analyzing and controlling the costs associated with manufacturing and production processes. They collect and analyse cost data, calculate production costs, determine cost variances and provide insights to management for cost optimisation and decision-making. Cost Accountants play a crucial role in improving operational efficiency and profitability.

Financial Analyst

Financial Analysts analyse financial data, perform financial modelling and provide insights and recommendations to support investment decisions, budgeting and financial planning. They assess financial performance, conduct risk assessments and evaluate investment opportunities. Financial Analysts often work in corporate finance, investment banking, or financial advisory firms.

Chief Financial Officer (CFO)

The CFO is a senior-level executive responsible for managing the financial operations of an organisation. They oversee financial planning, budgeting, financial reporting and risk management. CFOs play a strategic role in driving the financial success and growth of the organisation by providing financial leadership and guidance.

Begin learning more about accounting with accountancy coaching on Superprof.

Average Salary of Accountants in India Per Month

The average salary of an accountant in India can vary depending on factors such as experience, qualifications, industry, location and the organisation's size. Here is an estimate of the average salary of accountant in India per month

For entry-level accountants or freshers, the average monthly salary in India typically ranges from ₹20,000 to ₹40,000. However, this can vary based on the abovementioned factors, with salaries on the higher end for candidates with exceptional qualifications and skills.

Their salaries increase as accountants gain experience and move up the career ladder. Mid-level accountants in India can expect an average monthly salary ranging from ₹30,000 to ₹60,000 or more.

For senior-level accountants or those in managerial positions, the average monthly salary can range from ₹50,000 to ₹1 lakh or higher, depending on experience, industry and organisation size.

It's important to note that these figures are approximate and can vary based on various factors. Additionally, salaries may differ in different cities and regions within India, with metropolitan cities often offering higher salaries due to the higher cost of living.

Look for accounts tuition near me on Superprof today!

Salary of Accountant (Mumbai, Kolkata, Bangalore, New Delhi and Chennai)

The city-based salary of accountant (Mumbai, Kolkata, Bangalore, New Delhi and Chennai) can vary due to factors such as the cost of living, industry demand and the overall economic conditions in each city.

- Mumbai: Mumbai, being the financial capital of India, offers higher salaries for accountants compared to other cities. On average, the monthly salary for accountants in Mumbai can range from ₹25,000 to ₹60,000 for entry-level positions. Mid-level accountants can expect a monthly salary of around ₹40,000 to ₹90,000 or more, while senior-level accountants or those in managerial roles can earn monthly salaries ranging from ₹70,000 to ₹1.5 lakhs or higher.

- Kolkata: In Kolkata, the salary range for accountants is slightly lower compared to cities like Mumbai. Entry-level accountants can expect monthly salaries ranging from ₹20,000 to ₹45,000, while mid-level accountants can earn around ₹30,000 to ₹70,000 per month. Senior-level accountants may earn monthly salaries ranging from ₹50,000 to ₹1.2 lakh or more.

- Bangalore: Bangalore, known as India's technology hub, offers competitive salaries for accountants. Entry-level accountants in Bangalore can expect monthly salaries ranging from ₹25,000 to ₹50,000. Mid-level accountants may earn around ₹40,000 to ₹80,000 per month, while senior-level accountants can earn monthly salaries ranging from ₹70,000 to ₹1.5 lakh or higher.

- New Delhi: New Delhi, as the capital city, offers diverse job opportunities for accountants. Entry-level accountants can earn monthly salaries ranging from ₹20,000 to ₹45,000 in New Delhi. Mid-level accountants may earn around ₹30,000 to ₹70,000 per month, while senior-level accountants can earn monthly salaries ranging from ₹50,000 to ₹1.2 lakh or more.

- Chennai: In Chennai, the salary range for accountants is relatively lower compared to cities like Mumbai and Bangalore. Entry-level accountants can expect monthly salaries ranging from ₹18,000 to ₹40,000. Mid-level accountants may earn around ₹25,000 to ₹60,000 per month, while senior-level accountants can earn monthly salaries ranging from ₹45,000 to ₹1 lakh or higher.

Salary Increment for Accountants

There are several reasons why accountants may receive salary increments. Various factors, including individual performance, experience, qualifications, industry demand and organizational policies, can influence these increments. Here are some detailed reasons for salary increments for accountants:

Better Exam Grades

Strong academic performance, including achieving better exam grades, can positively impact salary increments for students pursuing a career in accounting. Employers often value candidates with a solid academic foundation, demonstrating a strong work ethic, discipline and a thorough understanding of accounting principles. Higher exam grades can make students more competitive in the job market, increasing their chances of securing lucrative job offers with attractive salary packages.

In their quest for better exam grades, students can seek additional support and guidance from qualified tutors on platforms like Superprof. These tutors can provide personalized instruction, exam preparation strategies and valuable insights to help students achieve their academic goals, potentially leading to improved career prospects and salary increments in accounting.

Alternative Courses and Additional Certifications

Pursuing alternative courses and acquiring additional certifications can significantly enhance students' skill sets and increase their earning potential. Besides traditional accounting qualifications, students can consider specialised courses or certifications in financial analysis, risk management, taxation, or forensic accounting. These additional qualifications showcase expertise in specific fields and can make students eligible for higher-paying roles or promotions within organizations.

Basic Skills Development

Basic skills are crucial in career advancement and salary increments for accountants. Some key skills that can contribute to salary growth include:

- Communication Skills: Effective communication, both verbal and written, is essential for accountants to convey complex financial information and collaborate with colleagues, clients and stakeholders. Strong communication skills can lead to better job performance and open doors to leadership positions with higher remuneration.

- Analytical and Problem-Solving Skills: Accountants with strong analytical and problem-solving skills can offer valuable insights and solutions to financial challenges. These skills enable professionals to identify inefficiencies, propose improvements and contribute to cost savings or revenue generation, making them more valuable to employers.

- Technology Proficiency: With the increasing reliance on technology in accounting, proficiency in accounting software, data analysis tools and spreadsheet applications is crucial. Accountants who can leverage technology efficiently and stay updated with emerging trends can streamline processes, enhance efficiency and add value to organisations. This competence can lead to salary increments and career progression.

- Continuous Learning: Accountants who commit to continuous learning and professional development are often rewarded with salary increments. Staying updated with changes in accounting standards, tax regulations and industry trends through workshops, seminars and professional courses showcases a proactive approach to career growth and can lead to enhanced job responsibilities and increased remuneration.

Performance and Achievements

Accountants who consistently perform well and exceed expectations in their roles are likely to receive salary increments. Organisations often have performance appraisal systems in place to evaluate employee performance. If an accountant consistently demonstrates exceptional skills, achieves targets and contributes significantly to the organisation's financial success, they may be rewarded with a salary increment.

Experience and Expertise

As accountants gain more experience and expertise in their field, they become more valuable to organisations. With increasing experience, accountants acquire in-depth knowledge, develop problem-solving abilities and demonstrate the ability to handle complex financial matters. As a result, they become eligible for salary increments that reflect their growing expertise and contributions to the organisation.

Discover accounts tuition near me when you search on Superprof.

Professional Qualifications and Certifications

Accountants who pursue additional professional qualifications, such as becoming a Chartered Accountant (CA), Certified Public Accountant (CPA), or Certified Management Accountant (CMA), enhance their skills and knowledge base. These certifications validate their expertise and make them more competitive in the job market. Employers recognise the value of such qualifications and may reward accountants with salary increments as they bring advanced skills and credentials to the organisation.

Industry Demand and Competition

The demand for accountants in specific industries or sectors can impact salary increments. Industries experiencing rapid growth, such as technology, finance, or consulting, often compete for top accounting talent. Organisations in these industries may offer higher salary increments to attract and retain skilled accountants to remain competitive.

Cost of Living and Inflation

Salary increments can also be influenced by the cost of living and inflation rates. Employers consider these factors when determining salary adjustments to ensure that employees' compensation keeps pace with the rising cost of living. In regions or cities with higher living costs, employers may provide higher salary increments to maintain employees' purchasing power.

Market Conditions and Economic Performance

The overall economic conditions and market trends can impact salary increments for accountants. During economic growth and prosperity periods, organisations may have the financial capacity to provide higher salary increments. Conversely, salary increments may be more conservative during economic downturns or challenging market conditions.

Overall, accounting in India provides a promising career path with abundant job opportunities, competitive salaries and the potential for growth and specialisation. The field continues to evolve with advancements in technology, financial regulations and business practices, making it an exciting and dynamic profession for individuals interested in finance, numbers and strategic decision-making.

Tally Accountant in India

Tally accountant in India is the desired job role, especially in the construction and manufacturing sector. You can learn tally to get an added advantage in your accounting career irrespective of the job title you take. It helps in enhancing the knowledge of inventory management, accounting, and taxation. Assistant Accountants, finance managers, accounts executive, accounts manager, etc. all require significant tally skills to increase productivity.

You can also expect a rise in your expected salary after acquiring a tally certificate. You may look for tally teachers and tutors on online platforms like Superprof. It is one of the leading platforms that help students find the best teachers in the world. You just need to enter your location and the subject. Scroll through the profile of hundreds of teachers to select the one that suits your interest and budget.

Accounting is one of the most desired professions that also yields a huge fortune and fame. You need to build your skills and gather enough knowledge to beat your contemporaries and secure the best position. The upper-level salaries differ from that of the entry-level salaries. However, it all depends on how well you adapt to the demand pattern of the market by acquiring the right skills.

Discover effective accounting classes online here on Superprof!

Summarise with AI: