'Have card, will shop' is the modern consumer's motto. These days, we're actually encouraged to pay using our bank cards - debit or credit, rather than hand over cash when we make a purchase. Indeed, the pandemic has made those payment methods an essential component of our lives. But even before COVID, consumers had begun to move away from cards altogether, relying on merchants' growing acceptance of Google Wallet and Apple Pay as legitimate forms of payment. Today, some outlets even accept cryptocurrencies; primarily Bitcoin. El Salvador has gone so far as to make Bitcoin legal tender throughout the country. So far, it and Cuba are the only nations to recognize any cryptocurrency as being equal to fiat. The dazzling array of financial access tools we have at our disposal today tempts us to believe that FinTech is a relatively new phenomenon. In fact, most associate the rise of FinTech with the establishment of the first blockchain, in 2009. However, FinTech and fin-tools go much further back in time:

| FinTech Timeline |

|---|

| 1886: transmission cables made it possible to send financial information over long distances and across borders. |

| 1967: The first automatic banking machine (and the handheld calculator) launched the modern FinTech era. |

| 2008: online banking, third-party payment systems and smartphone development revolutionize the world of finance. |

| 2008/2009: today's FinTech makes its greatest strides in developing markets; cryptocurrencies make waves and electronic wallets are introduced in the west. |

Before Finance Technology

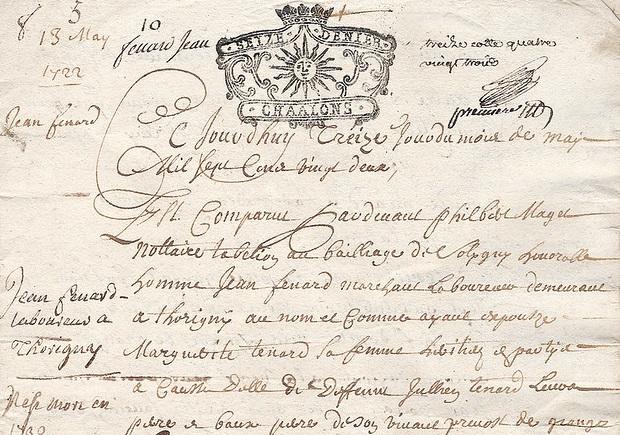

Long before the first telegraph wires were strung and the first underwater cables laid, travellers had to have a secure means of carrying money. The groups loosely labelled as travellers might be anyone from merchants and missionaries to explorers/adventurers and, of course, the wealthy. Obviously, they couldn't carry around hoards of gold or precious stones, nor could they simply wear their riches. Either of those solutions would just be begging for robbery - a quite common occurrence, in those days. Instead, travellers had less conspicuous options for transporting their access to money; one of them was the Letter of Credit.

The Earliest FinTech

Arguably, the second Industrial Revolution (ca. 1870-1914) made Financial Technology possible. It was during this time that the infrastructure needed to execute financial transactions long-distance was built. Two major technological developments spearheaded FinTech development: the telegraph and the railroad. Steamships, another product of this revolution, added to FinTech's potential but they didn't move as fast as the other two, and they maintained the same access to foreign shores that ships had always had. By contrast, railroads and telegraphs lost no time on docking or customs protocols; their overland travel assured quick funds disbursement. In the US, Western Union took advantage of the new telegraph network to institute the world's first wire money transfer system. The service, launched in 1856, largely did away with the need for stagecoaches having to carry large sums of money to banks in other states. Those coaches were frequent targets of highway bandits - hence, the term highway robbery. Western Union was a welcome innovation and, notably, marked the first instance of money changing hands in long-distance financial transactions. When the first transatlantic cable was laid in 1866, money gained even more mobility. Now, instead of having to wait for a ship to deliver financial communications from overseas, those missives could simply be transmitted without anyone having to leave their home port. This FinTech era lasted until about 1967, when Information Technology started its shift from analogue to digital. By then, credit cards had made their debut; they were fast pulling to the forefront of financial technology devices. To wit, Barclay's PLC introduced its Barclaycard in 1967, just ahead of the digital wave.

FinTech Goes Digital

Barclay's also installed the world's first cash machine; universally recognised as ATMs - automated teller machines. Although the Japanese pioneered a card-accessible cash dispenser that accorded customers 3-month loans in 1966, Barclays' was the world's first machine for customers to access their bank accounts around the clock. That hole in the wall kicked off the new era of financial technology.

FinTech to the Forefront

Thanks to financial technological systems, it soon became clear how and why American banks failed and took the rest of the globe's financial institutions down with them. As the headlines flew around the world, peoples' distrust in banks and financial institutions - even in their governments grew. As banks went broke and governments scrambled to save them; as citizens' outrage echoed and amplified... a lone voice quietly suggested there might be a better way to 'do' money. Late in 2008, someone calling themselves Satoshi Nakamoto published a paper online that described a system of financial transactions with no central authority, and governed by no single entity. They described the proposed technology as a blockchain, wherein the ledger recording each transaction would be kept by every participant - every computer (node) across the system. What celebrations could be had as we turned to 2009 were hardly enough to mask the shockwave the first 'block' caused. The mysterious Satoshi mined it as the world rang in the new year. And then, he disappeared. To this day, only one person or group is sure who Satoshi is but their implementation of the blockchain concept has set off wild speculation and a frenzy of FinTech innovation - everything from a smorgasbord of cryptocurrencies to exchanges for trading them. Mobile technology has also spurred FinTech development. Japan saw the earliest innovations of smart mobile technology. As early as 2002, while the rest of the world carried two devices, a mobile phone and a personal digital assistant, the Japanese were already making the most of their Danger Hiptop. Blackberry based its design on that device but, soon, other smart mobiles pulled ahead of the market. When Google introduced their digital wallet in 2011 (Apple brought theirs online in 2014), the wider financial world had yet to build the infrastructure needed for those applications' widespread usage. Indeed, the lag between product development and usability is one of the best reasons to work in FinTech...

Where Does FinTech Go From Here?

All of the possibilities inherent to cryptocurrencies and blockchain aside, there is substantial work needed to make such systems viable and accessible to all. For one, Bitcoin's proof-of-work scheme demands enormous energy reserves; the power it takes to calculate a single transaction has a dramatic impact on the environment. That's why new cryptocurrencies develop on proof-of-stake schemes; they are far less energy-intensive. Will Bitcoin's blockchain evolve? On the broader scope, FinTech's biggest leaps seem to take place in emerging markets. China's Alipay, the world's most widely-used mobile payment system has been in operation since 2011. Recently, China reported its goal of establishing the world's first fully digital fiat currency. Emerging markets - countries such as China and India never fully developed any banking infrastructure comparable to those in developed markets so, even though their FinTech infrastructure is well developed and widely used, they lack the physical institutions to back them up. Because these markets have less history with banking institutions, they are much better positioned to accept and develop FinTech as their primary financial vehicle. By contrast, in countries with longstanding banking traditions, there is an ongoing struggle between institutional money-handling protocols and the newer, decentralized, corporate ventures that eat ever more of banks' shares on the global market. The irony is that the world, and FinTech, still rely on those institutions for all financial transactions. Will FinTech ever become independent of banks? Will banks ever expand their services to include more FinTech? If you took FinTech courses and went to work in the finance sector, you could help make those decisions and bring about needed changes.

Summarise with AI: