With the New Year comes a natural refresh in your goals and objectives. For many people, it’s a great time to evaluate things like their budget and financial goals, job and career objectives, and investing strategy.

Setting short-term financial goals is a great way to start budgeting as you work towards a tangible result that happens in the near future.

Overwhelmed? Confused? Consult this quick guide to help get yourself on track for a financially abundant 2024!

What is Financial Planning?

Financial planning is the process of evaluating your finances, setting financial goals, and managing your money and resources to achieve your financial goals.

There are a few different common financial planning theories, and what works for one person won’t necessarily work for another. It depends on your personal assets, income, lifestyle, and goals.

When you go through the process of creating your financial planning objectives, you will get a much clearer picture of your current financial state, the goals you want to set, and the steps you need to take to reach those goals.

It involves creating a budget, saving for the future, investing your money, and managing your debt.

What Are the Benefits of Financial Planning?

Financial planning is a necessary part of adulthood and leading a life with less financial stress.

When you take the time to financially plan (and stick to your plan!) you can achieve goals like buying a house, taking a big vacation, saving for retirement, and paying for your children’s education.

Sound financial habits help you to live a life where you can afford the things you want and need.

Financial planning will also help you pay off any existing debt and understand how to best handle future debt, like student loans and mortgages.

Financial Planning For Young Adults

Most of us received little to no financial planning education from our parents or schooling, so we are left to try to figure it all out on our own.

Here are some of the best tips to get started with financial planning as a student or young adult.

Understand Cash vs Credit

It can be tempting to pay for everything with a credit card or tap to pay; it’s quick and easy and you don’t have to carry around cash.

But, that can be the very thing that skews your view and understanding of how much you’re earning and spending.

Building credit can be important, which a credit card helps with, but it can also turn into a problem if you don’t pay off your balance every month.

To get a better handle on things, try using only cash for a few months. Take out the cash you need to pay for everything you can (except for anything that can only be paid online), like groceries, fuel and commute fare, shopping, restaurants, and activities.

This will help you understand exactly how much value money has because you’ll feel your wallet get lighter as you go, and when you run out of cash, that’s it - no more resources for the month. It’s a hard-hitting lesson.

Build an Emergency Fund

As soon as you start earning some money, you should stash some of it away in a savings account that is easily accessible but keeps your funds safe.

In the event of an emergency - you lose your job, you’re injured or sick, your family experiences hardship, you get evicted, your car breaks down, a natural disaster, or an unexpected bill - you want to make sure you can cover as much of it as possible without resorting to a credit card charge or eating into your savings.

Typically, you should build an emergency fund that is at minimum 1 month of your typical expenses, but at least 3 months is a safer amount.

This takes a lot of time, but if and when you need to rely on it, you’ll be so glad you prepared.

Learn to Budget

The hardest part of finances for most people is the daily budget. There are so many things in our lives that chip away at our finances little by little that it’s both a) hard to keep track of and b) hard to imagine a life without all these little charges.

The first step is awareness, just like the cash vs credit step. Start by keeping track of every expenditure you make every day to find out where all your money goes and find out if there is a way for you to reduce spending or adjust what you buy to get more bang for your buck.

We will discuss budgeting techniques further on.

Start Saving for Retirement Now

After you stash away at least 1 month of expenses in your emergency fund, start saving for retirement. See if your employer offers any benefits in this area, like matching your contributions or providing a high-interest account. You want to invest your money in safe accounts so that your money makes money, giving you the best financial future possible.

Invest in Your Health

One thing you shouldn’t skimp on is spending money on your health. If you have a health issue, you should take care of it as soon as possible, even if it causes you some debt. What good is money if you are too ill, in too much pain, or not alive to enjoy it later?

Eat well, exercise, take care of your mental and dental health, and see a doctor regularly.

Insure Your Wealth

Get renter’s insurance, car insurance, health insurance, and pet insurance, and make sure your bank accounts are insured. Once you have something, you want to make sure that if something happens, you have recourse to help you recover financially.

Financial Planning Objectives

What can you work towards to give yourself the motivation to set a financial plan and follow through with the limitations you impose regarding your money?

For many of us, it’s hard to save money or follow a budget because it’s easier to just not do that and have fun instead.

When you set a goal that really means something to you, it’s much more likely that you will be able to meet your financial objectives.

How to Set a Financial Goal

Think about your short and long-term goals. This will inform your financial plan.

Short Term Financial Goals

In the short term, you might want to buy a specific thing like a new computer, a car, or an expensive pair of shoes. Other common short-term goals include things like a vacation or trip, going to an expensive restaurant, buying an engagement ring, or having an experience like skydiving or getting a tattoo.

Evaluate what you want to do in the near future and determine how much it will cost.

Medium Term Financial Goals

For goals that are between 2 and 10 years away, you may want to consider them to be a medium goal. What you put here depends on your personal timeline. In the medium term, most people aim to pay off debts, attend an educational program, have a wedding, and have a baby.

Long-Term Financial Goals

In the long term, most people plan to buy a house, help their parents in retirement, fund their child’s educational costs, retirement, and leaving a legacy.

Choose a goal that speaks to you the most to keep in mind and help you stay on track.

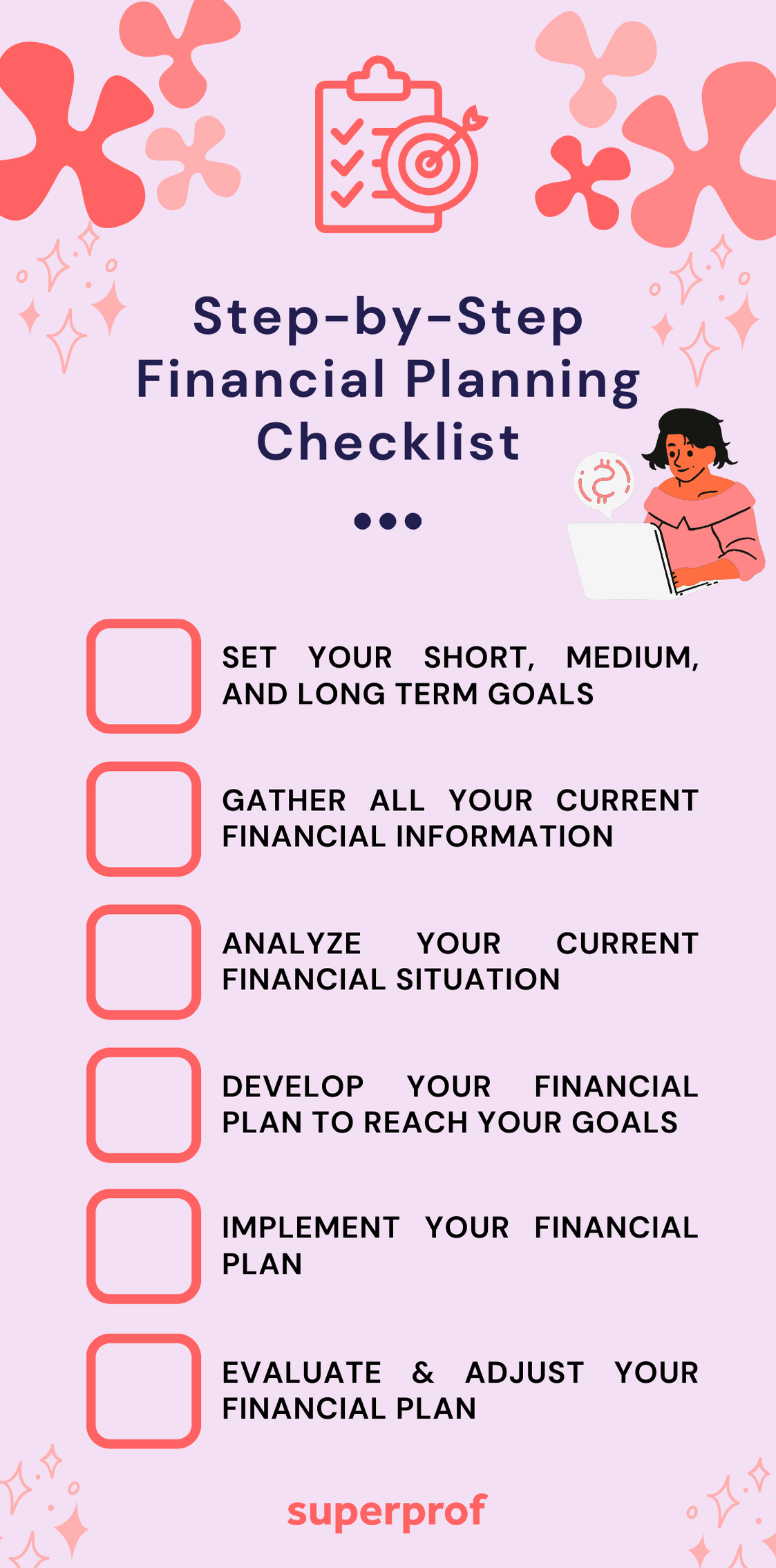

The Process of Financial Planning

The process of financial planning is simple, but it can also be scary. Take it one step at a time to get a good picture of your current financial state and the steps you need to reach your ideal financial situation.

Here are the steps in financial planning you need to take to start investing in a financially secure future.

1. Set Your Short, Medium, and Long-Term Goals

You already know how to set your goals, so this first step is easy!

Make a vision board or write your goals in your journal or a sticky note where you can see them often so you feel a strong desire to make smart financial choices to get closer to achieving your goals.

2. Gather Your Current Financial Data

Compile your current savings, credit cards, loans, debts, income, subscriptions, and other expense data so you can see it all in one place. You can choose to keep a digital or hand-written spreadsheet.

Try tracking all your expenses for one month to get a good idea of what you spend and where.

3. Analyze Your Current Financial Situation

Go through all your data and see where you can cut expenses, decide if you should move your money to a different account with a higher savings rate, see if you can refinance your loans, and more.

This is a hard step because you may have to come to terms with some hard truths and give yourself some tough love. Maybe you discover that you spend way too much on eating out, grocery delivery, fun activities, or that you have a subscription you didn’t even realize you were paying for.

Forgive yourself for spending in the past and resolve to do better in the future.

4. Develop Your Financial Plan

Learn about budgets (read on for some ideas) and decide how to implement these budgeting techniques in your life. You might start with one habit at a time, rather than trying to add all the new budgeting habits at once. You don’t want to get overwhelmed!

5. Employ Your Financial Plan

Execute your budgeting habits and any lifestyle changes you need in order to meet your financial goals. Remember to add them one at a time to avoid burnout and giving up!

6. Evaluate & Adjust Your Financial Plan

Re-evaluate your progress each month and tweak your habits and goals as needed.

Remember, financial progress is a marathon, not a sprint. And it’s a journey that is completely your own! If traditional budgeting measures don’t work for you, feel free to change them so that they do.

The best budget and financial plan are the ones you will actually stick to!

Intro to Budgeting

There are many different methods for budgeting out there, and you can use whichever method(s) works best for your lifestyle, goals, and personality.

Feel free to use multiple concepts from different budgeting styles and tweak them to suit your needs.

50/30/20 Rule

This is one of the most popular types of budgets.

Your goal is to manage your funds so that

- 50% of your income goes to your needs (necessary expenses like rent, insurance, food, healthcare, etc)

- 30% of your income goes to your wants (to keep life interesting, like dining out, shopping, vacation savings, etc)

- 20% of your income goes to savings and debt repayment (emergency fund, retirement account, student loans, auto loan, credit card payments, etc)

You can adjust the percentages to better reflect your lifestyle, and you can always change your percentages as you progress in your financial journey.

Having these goals helps you realize areas of your life where you can spend less and save more, and maybe even earn more money as well.

Zero-Based Budgeting

Another popular budgeting style, this concept requires you to track every penny of your income, expenses, and interest in your investment accounts.

You assign every cent to a job so that your money “leftover” is 0.

You can assign money to rent, food, savings, etc.

It’s a great way to get in touch with your actual financial habits, but it can be intense if you aren’t very detail-oriented or don’t have time to budget a little every day.

Envelope System

This is a great way to start budgeting to get yourself used to setting and sticking to spending limits.

For any expenses that aren’t only able to be made online (like rent or insurance payments), take the allotted money out of the bank and put it in an envelope. Use only the money in the envelope for these discretionary expenses (grocery shopping, clothes shopping, fuel, etc).

It’s impossible for you to overspend because you only have the physical cash, not a debit or credit card.

This method will make you understand exactly how much you’re spending.

Value-Based Budgeting

Instead of setting your budget based on “traditional” values, you can decide to set your budget based on your personal values.

Perhaps donating to charity is more important to you than buying new clothes. Instead of setting aside money for shopping, you can decide to dedicate your money to donations instead.

Maybe for you, travel is more important than buying a home. Budget more money towards saving for travelling than saving for a home, even though traditional budgeting wisdom says buying a home is more important.

We don’t all have the same values or want to live the same life. Make your life enjoyable by handling money in the way that suits you best!

Best Personal Finance Books For Youngsters To Read

To learn more about financial planning, budgets, investing, and more, check out these great financial books for students and young adults!

- Broke Millennial: Stop Scraping By and Get Your Financial Life Together by Erin Lowry

- Get the Hell Out of Debt: The Proven 3-Phase Method That Will Radically Shift Your Relationship to Money by Erin Skye Kelly

- Couple Goals: Building a strong financial future and an even better relationship by Nicole Haddow

- You Only Live Once: The Roadmap to Financial Wellness and a Purposeful Life By Jason Vitug

- I Will Teach You to Be Rich by Ramit Sethi

- You Can Get Rich Too: With Goal-Based Investing by PV Subramanyam and M Pattabiraman

- Let’s Talk Money by Monika Halan

- Retire Rich by P V Subramanyam

- What Every Indian Should Know Before Investing by Vinod Pottayil

Learning to budget and make a financial plan while you’re still a student or recent grad gives you a huge benefit! Getting your financial ducks in a row early on helps you make great financial decisions for the rest of your life.

Ready to start your year strong and learn how to manage your finances? Get started with these tips today!

Résumer avec l'IA :