Circumstances like the petrol and diesel prices going past the INR 100 per litre mark and the rupee falling to an all-time low against the dollar have many people worried. Those don't just include the average family man averting the effects of the COVID pandemic but also business people, economists, policy advisors, and politicians. Many are confident that the toll of the conflict between Ukraine and Russia, one that India has so far managed to walk the thin line, may very well be too much to bear on a global stage.

However, the economic situation within the country is more complex than that. Modern economists agree that it is an extensive hurdle to overcome, yet it is not impossible. So, let's look at the top 10 economic collapse examples and how their lessons can benefit India. We'll also examine how economic classes can help you obtain a broader perspective.

The current state of the Indian Economy

India is a major economic hub in terms of imports and exports. In fact, it is one of the few Asian countries with close ties to both NATO and China. Since the subsiding of the COVID pandemic, the country's state has been on a slight upward transition. In October 2022, India surpassed the UK to become the world's fifth-largest economy at $3.53 trillion. During the first fiscal quarter, India's GDP growth surged to 13.6 per cent, although financial experts have noted the effects wearing off since then.

Examples of Economic Collapses in the Past

While the challenges the Indian economy faces are massive, there are clear examples in the past that the current planners and citizens can use for information. Those include the following.

The Economic Crisis in Sri Lanka, 2022

Sri Lanka saw its tourism revenues drop 86% between 2018 and 2020. That was partly due to the persistent terror attacks but primarily due to the effects of the pandemic. Combined with reducing corporate taxes and removing Value Added Tax (VAT) from 15% to 8%, it reduced the government's capacity to provide financial stability. A few high-interest, short-term loans were the last straw.

The key takeaway for India is that the government needs to collect taxes from those capable of paying them. A billionaire should sacrifice his 3-day sailing trip to Bali if the same amount of money can feed 100 people in a desolate village suffering from drought.

The Global Financial Crisis, 2007-08

Every nation felt the effects of the 2008 recession. It came about from the bursting of the housing bubble in the US. It saw the biggest stock market crash since the Great Depression and large firms from the likes of the Lehman Brothers, an investment company that had existed since 1847, filed for bankruptcy. Financial experts predict the recession caused hundreds of billions in income losses by November 2014.

The lesson learned here is that a country should diversify its focus, and the people should have faith in multiple passive income benefits. India is currently experiencing something similar, with most people only focused on buying land and properties. The government should create viable schemes that promote investment in sustainable business options such as green energy and organic farming.

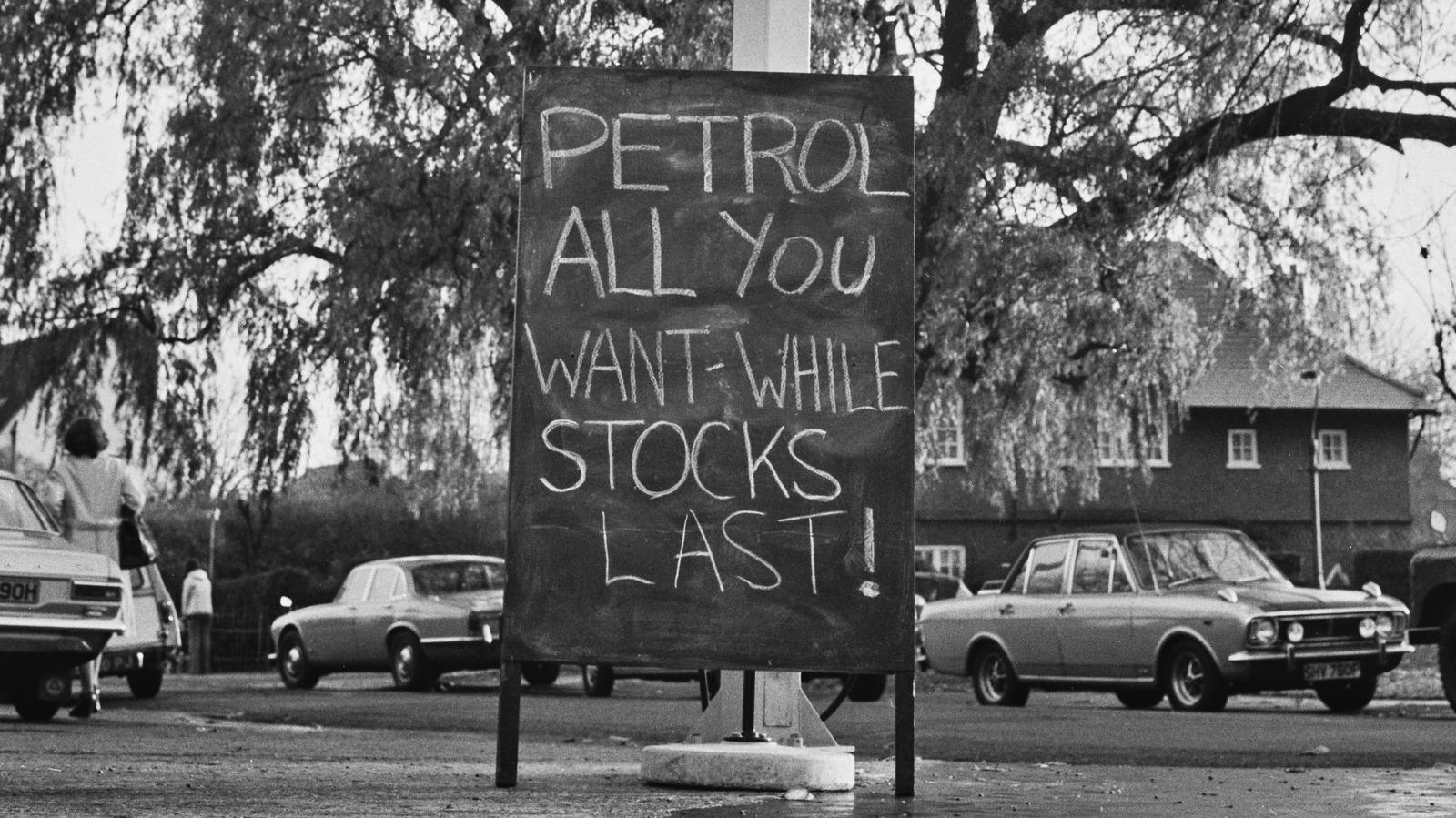

The OPEC Oil Price Shock, 1973

The Organization of the Petroleum Exporting Countries (OPEC) retaliated against the US sending arms to Israel during the Fourth Israel-Arab war in the early 1970s. Yet, the change was felt by the rest of the world as the price of oil nearly quadrupled. It saw the collapse of an extensive automobile powerhouse, Detroit, as people started buying more fuel-efficient hatchbacks instead of burly muscle cars come 1973.

The price of oil further affected other prices that depended on transportation and logistics. The cost of food items, medicines, plastics, and other essential products also skyrocketed. With the automobile companies shutting down, the US experienced a harsh recession. Many global markets also halted as the scope of economics seemed uncertain.

The Asian Crisis, 1997

The trade route comprising Indonesia, Thailand, Malaysia, Singapore, and South Korea contributes immensely to global trade. Over time, the influx of investments created several challenges, as Thailand ran low on their United States dollar reserves. The crisis came to a head in 1997 when the federal tax rates for several Southeast Asian nations reached an all-time high. Unemployment skyrocketed and the Days Inventory Outstanding (DOI) reached record lows, so much so that the International Monetary Fund had to step in.

A country like India can deduce from this example that just because new ventures are bringing in a massive cash flow, you must retain investors' trust. Sure, a few hiccups can delay the loss, but it helps to report your capabilities and make the necessary deadlines accurately. DOI is an imperative value to consider, and a dollar lost on faith can cost hundreds in the following decades.

The Swedish Financial Crisis, 1990-94

Many were astonished at the performance of small European countries like Sweden and Finland that handled the global financial crisis of 2008 pretty well. That's because they already had systems in place when they suffered that on a lower magnitude in the early 1990s.

Like in the United States, a housing bubble created generous prospects for banks to give out loans. However, those banks were left with billions in bad debt when that bubble burst. The Swedish government immediately raised rates so much that it was next to impossible for banks to report an extended credit, with unemployment remain steady. The two biggest banks were nationalised and stabilised with 64 billion kronor. Later, a new federal committee oversaw a transition period. It facilitated the banks' sale of all collateral assets to recuperate some losses.

The Indian Economic Crisis, 1991

It all started during the mid-1980s when India found its trade deficit slowly increasing. Combined with the Gulf War and the collapse of the Soviet Union, the value of the Indian rupee plummeted drastically. Even the World Bank refused to assist. The government airlifted its gold reserves to the IMF as a last resort. It opened softer avenues to foreign investment once P.V. Narasimha Rao took over as Prime Minister and appointed Dr Manmohan Singh as the new Finance Minister.

Today, India faces a similar situation. The Indian rupee is in freefall against the US dollar, and the war between Russia and Ukraine destabilised the prices of critical imports. Although there has been no need (yet) to exhaust the foreign exchange reserves, the trade deficit grew to $27.98 billion as of August 2022.

Black Monday, 1987

One of the most worrying stock market crashes occurred on October 17, 1987. Following a massive rise of 296% in the nineteen largest markets in the world, there was a record high in several companies' shares. Yet, the decline of the US dollar since December 1986 forced the Federal Reserve to increase interest rates. In retaliation, the Deutsche Bundesbank raised its interest rates, sparking speculation that a bear market was around the corner.

In fear, several investors started shorting a few stocks within the Dow Jones Index. A few significant shortenings followed in the S&P 500 soon after. The Federal Reserve rushed to stabilise the market to stop the fall. By the end of the day, the market had dropped more than 20%, with markets worldwide losing approximately US $1.71 trillion.

The Latin American Debt Crisis, 1982

Known popularly in the region as 'The Lost Decade,' the Latin American debt crisis was a great turning point for the economy that mainly depended on non-industrial exports. During the mid-1970s, the effects of the oil shocks were starting to take a toll in countries like Venezuela and Brazil. Several commercial US banks had reserves invested in such countries. But, due to the tightening of American monetary policy, they were forced to raise the interest rates for extended loans.

India can learn plenty from the Latin American debt crisis. It shows that no matter how much any organisation seems generous or willing to invest, geopolitical challenges can change the entire scenario on a whim. Thus, economies should remain stable on their own, with any external investments augmenting the economics situation in place of being the backbone.

The Great Depression, 1929-41

One of the most well-known financial tragedies in modern history, the Great Depression was a period of dire economic crises in many countries, including the United States, that commenced in the late 1920s. The stock market crash triggered a domino effect that soon involved the rest of the world. During that period, there was a global recession. Many people didn't have enough food to eat, and entire families starved to death.

The Indian economic policy should avoid such crises at all costs. It starts with reducing the wealth gap. According to a recent report by Oxfam International, the top 1% of Indians control 77% of the nation's wealth.

The Great Depression of the British Agriculture, 1873-96

While most people are familiar with the Great Depression that occurred in the 1930s, another caused an unemployment crisis in the UK earlier. The United States and Canada ramped up their grain production capacities, using new cheap transportation like steam ships to export any excess to other countries.

As such, the volume of global grain supply increased, and the price fell. That affected the growth of countries like Great Britain. Many books on economics designate the period between 1873 and 1896. Yet, it wasn't until after the Second World War that the UK got its food production back on track.

The lesson here is that it doesn't matter if you achieve growth in supplying a single essential. If another country (say Russia) can offer the same resource more efficiently, the economy can change to face various issues.

How Superprof can help you prepare for an economic collapse

You can't leave everything to the government to manage an economic collapse. One proven method is to prepare yourself by spotting the signs as early as possible. That comes with understanding micro and macro economic theories and spotting the telltale signs of an impending crisis. Superprof can help you do just that.

At Superprof, we believe in all users' freedom of choice. That's why we present you with a comprehensive list of economic experts, allowing you to consult with them before taking up tuition. We offer affordable plans for highly flexible classes to assist your social development per a schedule you're comfortable with.

Summarise with AI: